Jim Rowley

Senior Investment Analyst of Vanguard Investment Strategy

Get Updates from Jim Rowley

I am a fan of movie trilogies, and my favorites include those that involve Luke Skywalker and Jason Bourne. Trilogies interest me because, while they consist of separate movies, they still share an overarching story line. That’s not dissimilar from three separate investment strategies that share an overarching goal of generating income. Those strategies—overweighting corporate bonds, substituting dividend-paying stocks for bonds, and executing a duration tilt—are what could be referred to as The Search for Yield trilogy.

While generating income in today’s low-yield environment is a challenge, Vanguard Chief Economist Joe Davis recently discussed the reach for yield as one of his areas of concern. When we revieweach movie (strategy) in The Search for Yieldtrilogy, viewers (investors)will note that each is characterized by the trade-off between return and risk.

Overweightingcorporate bonds

Many investors have allocated a larger portion of assets to corporate bonds, including those that are rated below investment grade. This type of strategy is likely to provide investors with higher yields relative to Treasuries over the long term. However, much like Frodo Baggins, some investorsmay not be fully aware of the risks these decisions entail. Investors may enjoy the benefits of more income, but higher yields are intended to compensate investors for the additional risks, namely default risk. The figure below shows that the current level of compensation investors receive for taking default risk seems a bit on the low end of the historical range. However, as I have noted before, credit risk should also be viewed in the context of equity risk. We like to remind investors of both of these risks because taking the blue pill could lead to a world that doesn’t fully describe them.

Substitutingdividend-paying stocks for bonds

A good way to better understand dividend-payingstocks is to go back to the future … or at least back to a blog Joe Daviswrote in 2011. Even then, Joe was highlighting the risks associated with filling a portfolio’s bond capacitor with dividend-paying stocks. While dividend-paying stocks may provide solid income and greater capital gains relative to bonds in low–interest rate environments, investors should consider whether this is worth the increase in volatility. The magnitude of loss for stocks is several multiples greater than that of investment-grade bonds. The figure belowillustrates why even dividend-paying stocks are not immune to equityrisk. They are not suitable substitutes for bonds because, after all,they are still stocks … much as no matter how human the T-1000 looked, at the end of the day, it was still a machine.

Executing a durationtilt

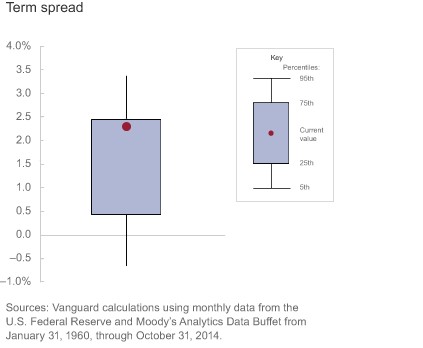

Investors seem to be treating longer-duration tilts as movie buffs do the third Godfather—they pretend it doesn’t exist. For severalyears now, investors have shied away from longer-term bonds for fear of risingrates. Their fears are valid. If long-term and short-term interest rates were to rise by the same amount, long-term bonds would suffer greater capital losses. But this typically doesn’t happen, because most interest ratemovements are not parallel shifts of the yield curve. Vanguard’s base-case scenario in the current environment is for a bear flattening of the yield curve, wherein shorter-term rates rise more than longer-term rates. Of course,we can’t tell with certainty that this will occur. The figure below shows that the compensation for extending duration is currently higher than it has been historically. Investors who tilt toward short duration bear the risk off or going the additional yield; investors who tilt toward long duration bear the risk of relatively higher volatility. Either choice comes with a form of risk.In his quest for archaeological returns, Henry Jones Jr. seemed to face risks with every choice too.

None of this suggests we advocate for overweighting corporate bonds, substituting dividend-paying stocks for bonds, or executing along-duration tilt to generate income. (We do advocate for total-return investing, though.) We only point out that each of the strategies in The Search for Yield trilogy is characterized by the trade-off regarding return and risk. In investing, the enduring nature of that trade-off tends to die hard.

Jim Rowley, Senior Investment Analyst of Vanguard Investment Strategy.

© 2014 The Vanguard Group, Inc. All rights reserved. Usedwith permission